As parents ourselves, we know what your days look like - school runs, laundry piles, meal planning and all the magical chaos that comes with raising children. The last thing you need is to unravel a complicated pricing structure or decode financial jargon.

We know parenting isn't easy, but investing in your child's future should be.

Not ready to commit? No problem. Download our app for free to see how contributions into an investment account over the years can grow over time to help your child one day buy their first home or go to university.

As with other investment service providers, we cover our costs through a platform fee (i) on your child's balance (0.5%pa). BlackRock, your expert investment manager used by millions worldwide, charges an investment management fee (i) (0.17%pa) and this charge is included in the valuation of your child's balance.

We speak human, not jargon:

(i) Platform Fee: We believe in doing what's right for your child and that means being open about costs. Our platform fee covers everything that keeps your child's investment account running smoothly, including setting up the account, managing it day-to-day, trading, transactions and admin. We don't charge any exit fees, so if you ever choose to move your child's investment elsewhere, you can do so freely. And any interest earned in the account belongs entirely to your child - we'll never keep it.

(i) Investment Management Fee: We want to do what's right for your child and that includes making sure their investments are managed with care and expertise. This fee covers BlackRock's expert investment team choosing, monitoring and adjusting your child's portfolio to help it grow over time. It means they're working behind the scenes to keep your child's money invested in a suitable mix of investments and to respond to market changes - all so you don't have to.

| Fee Type | Fidelity | Hargreaves Lansdown | Mia Wealth | AJ Bell | Nutmeg | Wealthify** | Bestinvest | Vanguard**** | MoneyFarm** | Moneybox*** | Charles Stanley | GoHenry****** |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Monthly Fee | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £0 | £1pm | £0 | £3.99pm |

| AUM Fee | 0% | 0% | 0.5% | 0.25% (max £2.50pm) | 0.75% | 0.6% | 0.4% | 0.15% (max £31.25pm) | 0.45% (min £1.25pm) + 0.24% (instrument costs) | 0.45% | 0.3% (min £5pm) | 0.45% |

| Investment Management Fee | 0.42%* | 0.54%* | 0.17% | 0.31%* | 0.23%* | 0.43%* | 0.66%* | 0.26%* | 0.17% | 0.4%* | 0.68%* | 0.22% |

| ETF Dealing Fee | £0 | £0 | £0 | £1.50 | £0 | £0 | £0 | £7.99 | £3.95 | £0 | £4 | £0 |

| Minimum Investment | £100 or £25pm | £100 or £25pm | £20 | £250 or £25pm | £500 | £1 | £50 | £100pm or £500 | £500 | £100 | £50 | £1 |

| Annual cost for £1,000 AUM across two Junior Stocks & Shares | £4.20 | £5.40 | £6.70 | £8.60 | £9.80 | £10.30 | £10.60 | £12.09 | £16.50 | £20.50 | £74.80 | £102.46 |

* Average investment management fee. Individual fees may vary depending on fund selection. In contrast, Mia Wealth's investment management fee is charged by BlackRock (0.17%pa) and does not vary - this charge is included in the valuation of your investments.

**Wealthify and MoneyFarm require you to do a suitability assessment.

***Moneybox JISA is not available unless you have an adult account.

****Vanguard Junior Stocks & Shares ISA has a 0.15%pa (max {31.25pm) AUM fee (see table below for comparison), the adult Stocks & Shares ISA has a £4pm membership fee for balances under £32,000.

*****GoHenry Junior Stocks & Shares ISA is only available for children aged 6 years+.

*If your existing provider still relies on physical paperwork, we won't be able to transfer as we're a fully digital app. However, do let us know and we'll happily contact them to make the case for them to go digital. We believe the industry should be efficient, digital-first, and family-friendly (because we know busy parents don't have time for printing and posting forms!). We're here to challenge the old way of doing things and make investing simpler and smarter for everyone..

There will be a price to access Mia's premium features. These features have been thoughtfully designed to enhance your child's future. At launch, we'll be offering an exclusive early-bird rate as a thank-you to those who join us from the very beginning. The early-bird price of these features will be confirmed closer to launch and we're confident in the additional value it will bring.

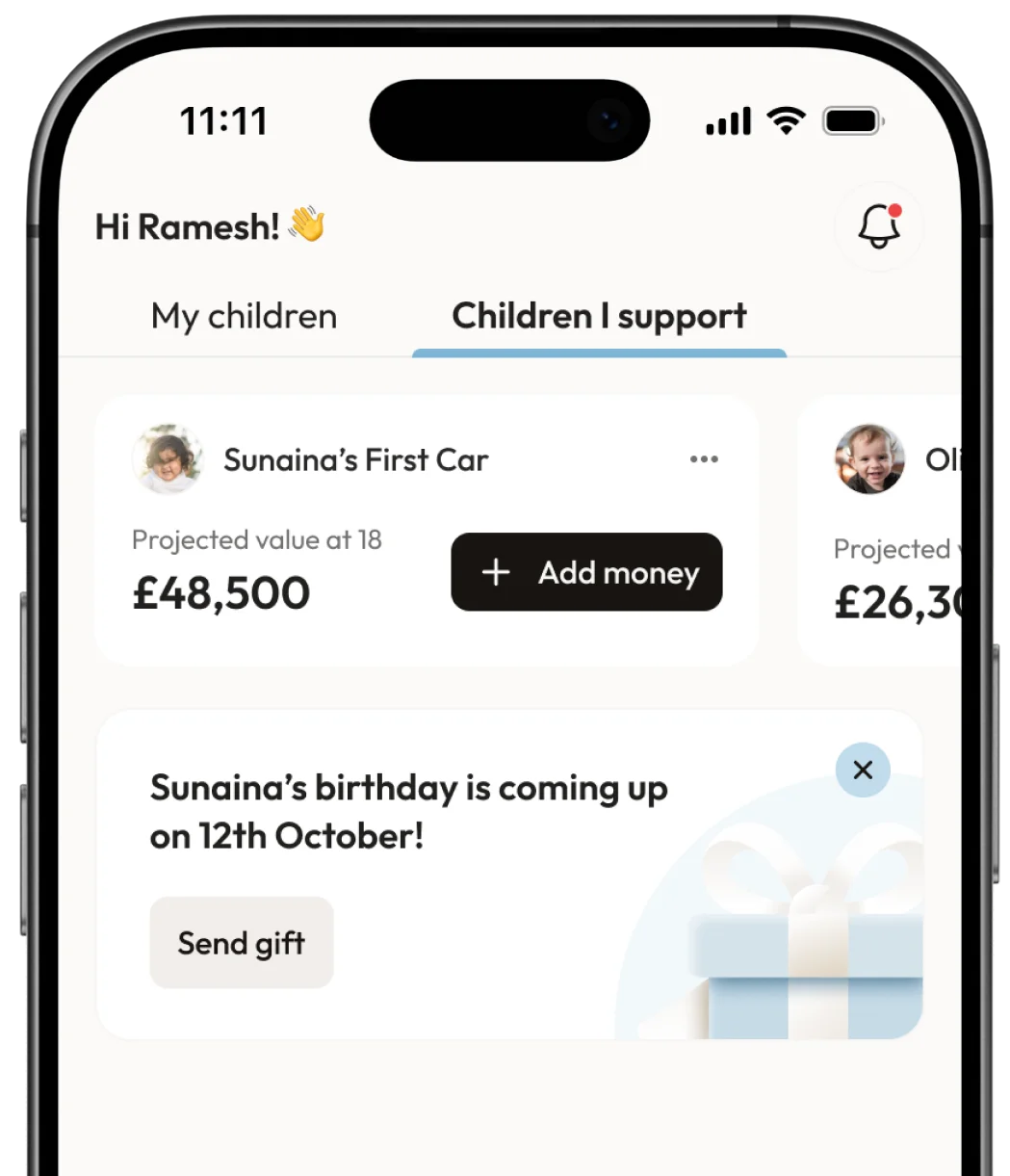

With premium features, family and friends can contribute directly to your child's future, track their gifts and leave messages your child will cherish forever (stored in Mia's Memory and unlocked on their 18th birthday).

Imagine their 18th birthday, they'll receive the gift of a lifetime - a financial foundation built by everyone who loves them.

Join hundreds of families already on the waitlist for early access.

Capital at risk

Join today