Think of the FSCS as your financial safety net – it's there to catch you if something goes wrong.

The Financial Services Compensation Scheme (FSCS) is the UK's independent watchdog that steps in when financial firms fail. If a bank or investment company goes bust and can't return your money, the FSCS has your back.

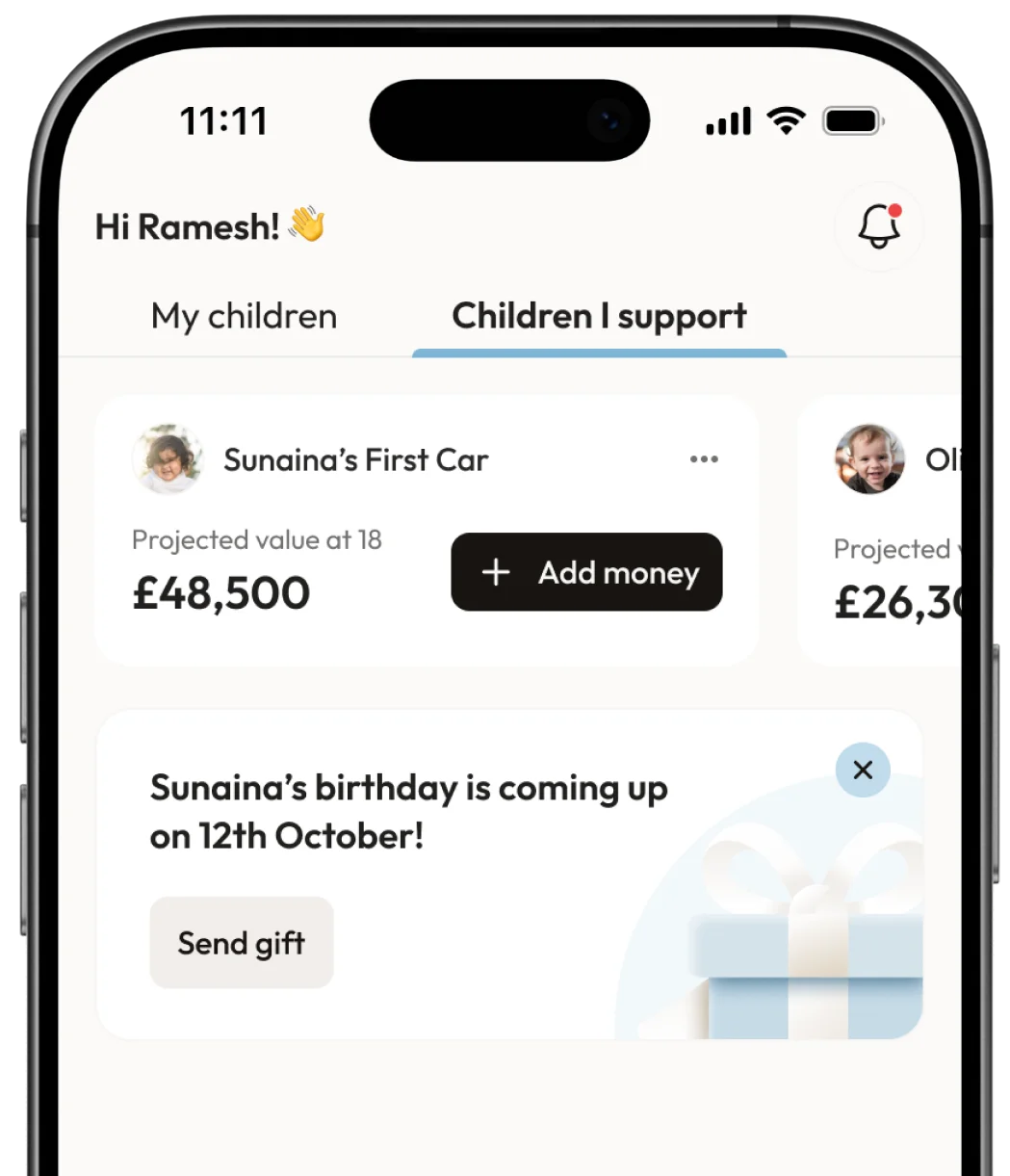

We work with regulated investment providers who keep your money in special client accounts with UK banks covered by the FSCS. Your child's future is protected every step of the way.

Up to £85,000 per person, per bank. So if your bank fails, you're covered up to this limit.

The £85,000 limit applies per banking licence, not per account. Some banks (like Halifax and Bank of Scotland) share the same licence, so check if your banks are linked using the FSCS tool.

If an investment firm fails, you're covered up to £85,000 per person, per firm. This protects against the firm failing – not if your investments naturally go up and down (that's just how investing works!).

For bank failures, compensation usually arrives within seven working days – often automatically, no forms to fill out.

The FSCS costs you nothing. It's funded by the financial industry but works independently to protect families like yours.

The bottom line? Your child's financial future has multiple layers of protection, giving you complete peace of mind as you build their tomorrow.

Join hundreds of families already on the waitlist for early access.

Capital at risk

Join today